Development Review

Short Term Rentals

A short-term rental (STR) is the temporary rental of residential rooms or homes. These are often listed on platforms such as Airbnb and HomeAway. City of Lincoln regulations do not directly address STRs.

Discussion Draft

In March 2019, the Nebraska Legislature passed Legislative Bill 57 (LB57), which limited the regulations that municipalities can impose on STRs while allowing typical zoning and building code issues to be addressed.

The City of Lincoln needs to update its Municipal Code to better address LB57 by establishing licensing and life safety standards for STRs. The Discussion Draft available on this page was created as a starting point for discussion and comment by the public regarding STRs in Lincoln.

The feedback received from the public will help direct the finalized proposal presented to the Planning Commission and City Council. Public hearings on the changes are anticipated to take place during 2020.

Open Houses |

||

|---|---|---|

| Date | Location | Meeting Materials |

| January 21, 2020 5:00 p.m. - 6:30 p.m. |

Culler Middle School 5201 Vine St., Lincoln, NE |

Presentation |

| January 29, 2020 5:00 p.m. - 6:30 p.m. |

Cavett Elementary School 7701 S. 36th St., Lincoln NE |

Presentation |

Comments and Questions

Your comments and questions are welcome.

- Comments: To submit a comment, please complete a brief questionnaire at the link below and submit your comments to the Planning Department. There is an opportunity at the end of the questionnaire to provide additional comments.

Questionnaire

Questionnaire - Questions: Questions may be directed to Rachel Jones at rjones@lincoln.ne.gov or (402) 441-7603.

Frequently Asked Questions (FAQs)

What is a Short-Term Rental (STR)?

A short-term rental (STR) is a rental of 30 or fewer consecutive days that is often listed on platforms such as Airbnb, VRBO and HomeAway. Short-term rentals are distinct from residential rentals lasting over 30 days, which are considered long-term rentals and are classified as a dwelling under the zoning ordinance.

What are the current regulations on short-term rentals in Lincoln?

The City of Lincoln Municipal Code does not presently address short-term rentals with any specificity. The City has taken the position that short-term rental is a permissible "home occupation" use of dwellings in residential districts. The City has also interpreted Lincoln Municipal Code to permit short-term rentals of dwellings in zoning districts that allow hotels and motels. The City is embracing the passage of Nebraska Legislative Bill 57 as an opportunity to specifically address how to regulate short-term rentals harmoniously with other land uses in our city.

How are Lincoln's regulations currently being enforced?

The City of Lincoln has temporarily stopped enforcement of its current short-term rental regulations. The regulations are not being enforced due to the passage of Nebraska Legislative Bill 57 regarding short-term rentals. Lincoln is in the process of updating the Municipal Code to better address enforcement issues.

What is LB57 and what does it mean for regulating short-term rentals in Lincoln?

Legislative Bill (LB) 57 was approved in March 2019 by the Nebraska Legislature. LB57 prevents municipalities from prohibiting Short-Term Rentals. It limits the regulations that municipalities can impose on them, but allows for regulations to address typical zoning matters as well as issues such as noise, property maintenance, fire and building codes. LB57 also allows sales and occupation taxes to be collected on short-term rentals.

What changes are being considered to the regulations on short-term rentals?

The City has put forth a Discussion Draft found on this web page that is intended to be a starting point for a community discussion on the topic of short-term rentals. Feedback is welcome on any aspect. Comments will be considered and incorporated into a finalized proposal that will be presented and voted upon at public hearings at the Planning Commission and City Council. Public hearings are anticipated to take place in 2020. Check this page for periodic updates about the proposal and anticipated timeline.

What taxes would be collected on STRs?

There are several forms of taxes that potentially apply to STRs.

Hotel Occupation Tax is a locally imposed tax collected by the City of Lincoln. Currently, the Hotel Occupation Tax does not apply to STRs. An amendment to Title 3 of the Lincoln Municipal Code, Revenue and Finance, would revise the definition of "Hotel" to include STRs. If that change were approved, Hotel Occupation Tax would be imposed by the City on each STR listing at the rate of 4% of gross revenue.

STR hosts may have an obligation to independently submit local Hotel Occupation Tax if it is not collected automatically by the hosting platform.

In addition to the locally imposed Hotel Occupation Tax, the State of Nebraska collects state and county lodging tax and local sales tax. Many of the larger STR hosting platforms collect and submit state and county taxes on behalf of the hosts.

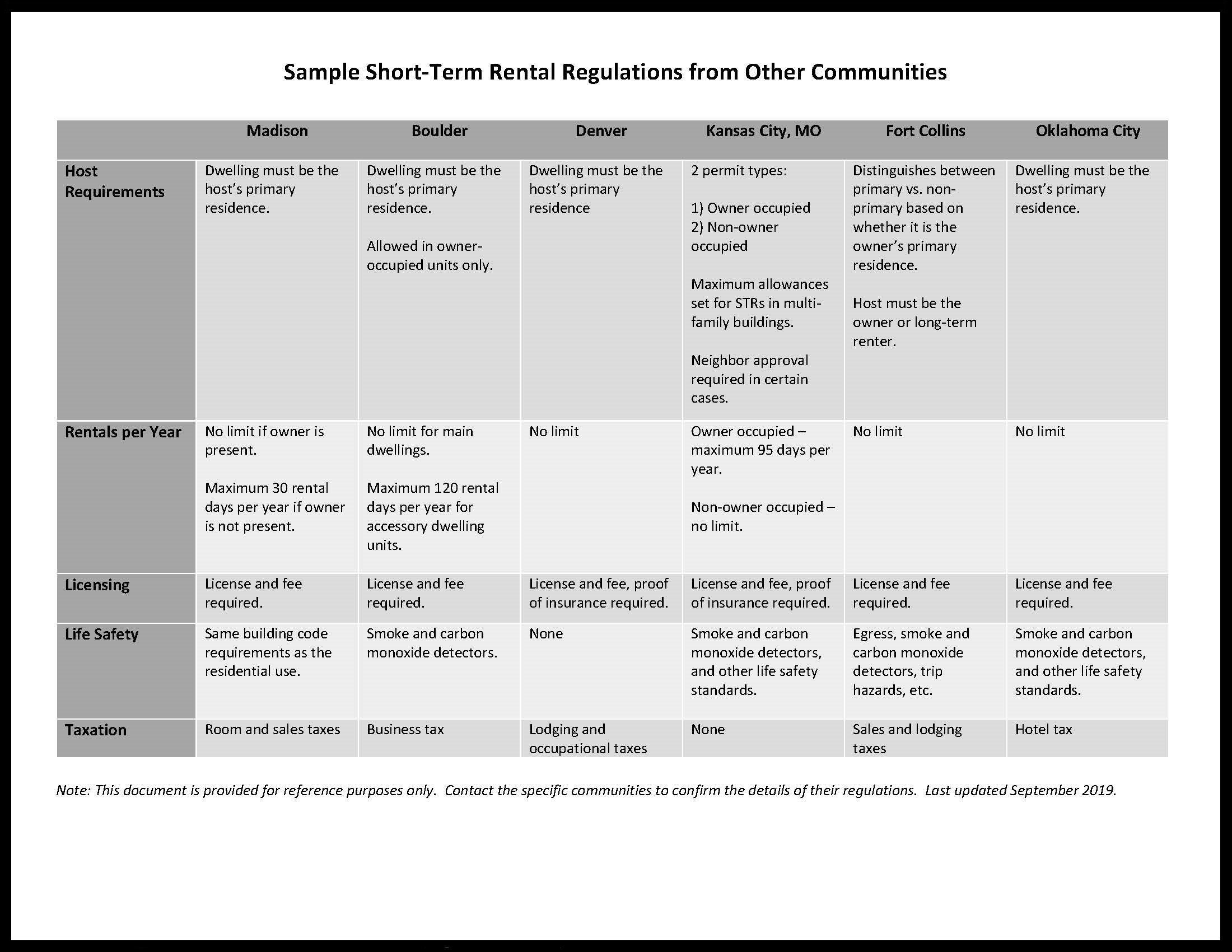

How do other communities regulate STRs?

Regulations vary widely by city and state. Many communities are in the process of creating or updating their STR regulations. A summary of the regulations in several communities has been provided here.